How to Use Drift Protocol v24.12.3: A Complete Guide

Introduction: What Is Drift Protocol?

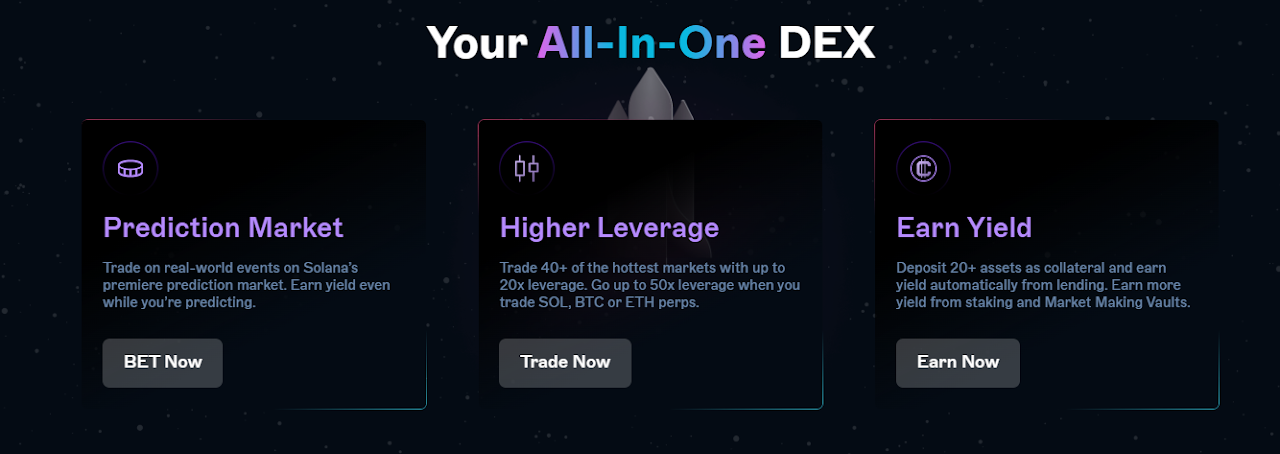

Drift Protocol is a decentralized exchange (DEX) built on the Solana blockchain that specializes in perpetual futures trading, offering deep liquidity, low fees, and lightning-fast execution. Drift Protocol+2Drift Labs+2 It’s non‑custodial, meaning you trade directly from your wallet, and it supports cross‑margin accounts so you can efficiently allocate collateral across multiple positions. Drift Protocol+1

Why Use Drift Protocol?

- High performance: Thanks to Solana, trades settle in sub-second finality, making Drift very fast. Drift Protocol+1

- Capital-efficient trading: Cross-margining means your collateral is shared across positions, which reduces the risk of forced liquidation and helps you use capital smartly. Drift Protocol Space+1

- Deep liquidity: Drift uses a hybrid liquidity model—including a virtual Automated Market Maker (vAMM), limit order book, and Just‑In‑Time (JIT) liquidity auction—to deliver tight spreads. LeveX

- Advanced risk management: The protocol has dynamic funding rates, on-chain liquidation mechanisms, and an insurance fund to help protect traders. Drift Protocol

- Earning opportunities: On top of trading, you can lend, borrow, stake DRIFT token, or provide liquidity. Drift Protocol

Step-by-Step: How to Use Drift Protocol

- Set Up Your Wallet

- Use a Solana-compatible wallet like Phantom or Backpack. Drift Protocol Space

- Make sure your wallet is funded with a supported collateral asset, typically USDC or other tokens supported by Drift. Drift Protocol

- Connect to the Drift App

- Go to the official Drift trading app: Drift Protocol App

- Connect your wallet by clicking “Connect Wallet.” Because Drift is non-custodial, you maintain full control of your assets.

Additional Features: Earn & Build

- Lend / Borrow: You can deposit tokens to earn yield or borrow assets within Drift’s lending markets. These funds also act as collateral for your perpetual trading. Drift Protocol

- Stake / Insurance Fund: You can stake assets into Drift’s insurance fund to earn a share of the protocol’s revenue. Drift Protocol

- Market Maker / JIT Liquidity: For advanced users, Drift supports JIT (Just-In-Time) liquidity provision—market makers can bid to fulfill orders at execution time. Drift Protocol Space+1

- Governance & DRIFT Token: If you hold DRIFT tokens, you may participate in governance decisions and earn protocol rewards. LeveX

Risks & Best Practices

- Leverage Risk: High leverage amplifies both gains and losses. Use responsibly and monitor your liquidation price.

- Smart Contract Risk: As with any on-chain protocol, smart contract bugs or exploits are a risk.

- Oracle Risk: Drift relies on on-chain oracles (such as Pyth and Chainlink) for price feeds. Sudden oracle issues can affect liquidations. Drift Protocol Space

- Hidden Fees Caution: Some users have reported unexpected costs—for example, on initial deposit or account creation. > “I lost 1.8 SOL … There was a hidden fee …” Reddit

- Sub‑account Architecture: Drift uses sub‑accounts (PDA addresses) to manage trades. While non‑custodial, funds are held in program-derived accounts. Reddit

Tips for New Users (Experience-Driven Advice)

- Start with small collateral until you’re comfortable with how margin and liquidation works.

- Use limit orders if you want more control over your entry price.

- Practice using Drift with a test wallet or minimal exposure before scaling up.

- Stay active in the Drift community (Discord, documentation) to learn strategy ideas and risk management.

- Keep an eye on governance updates; protocol parameters (like funding rate, fees) change over time.

Why Drift Protocol Is Authoritative & Trustworthy

- Drift’s smart contracts have been audited by respected security firms like Trail of Bits. Drift Protocol

- It’s fully open-source: developers can inspect code, and the protocol supports SDKs and API tools. Drift Protocol

- Cross-margining and JIT liquidity show Drift’s design is capital-efficient and thoughtful, not just a simple leverage DEX. Drift Protocol Space+1

- Transparent risk mechanisms (insurance fund, on-chain liquidation) help build trust.

Conclusion

Drift Protocol v24.12.3 (interpreted here as the current stable Drift V2) offers a powerful, decentralized way to trade perpetual futures on Solana. With cross‑margin, deep liquidity, sub-second settlement, and strong risk-management design, it combines many benefits of centralized exchanges—but without giving up custody of your assets.

Whether you’re a trader looking for leverage, a DeFi user who wants to lend or stake, or a developer interested in building trading bots, Drift Protocol provides a flexible, high-performance toolkit.

To dive deeper, check out the official Drift Protocol documentation: Drift Docs

- Deposit Collateral

- Deposit USDC or any collateral token supported by Drift. This will act as your margin. Drift Protocol

- Once deposited, your funds are available in a “cross-margin account,” which you can use to open futures positions. Drift Protocol Space

- Trade Perpetual Futures

- Navigate to the Perpetuals section in the Drift UI. Drift Protocol

- Choose your market (for example, BTC-PERP, ETH-PERP, SOL-PERP) and decide whether you want to go Long (buy) or Short (sell) based on your market view. Drift Protocol

- Specify your position size: you can enter the size either as the underlying asset amount (e.g., 0.1 BTC) or in USDC collateral. Drift Protocol

- Use the leverage slider to adjust how much leverage you want (e.g., up to 20x for many assets; some markets support even higher). Drift+2Drift Protocol+2

- Choose an order type: market orders (execute immediately) or limit orders (execute at your target price). Drift Protocol

- Review and confirm: The interface will show you a confirmation modal. Once confirmed, you sign a transaction in your wallet to place the trade. Drift Protocol

- Manage Open Positions

- To adjust an open position, simply place another trade in the same asset (buy or sell) to increase or decrease your exposure. Drift Protocol

- Changing leverage will modify your liquidation price, so be careful and monitor your position health. Drift Protocol

- To exit a position, go to the “Positions” tab in the UI and click Close. Confirm via wallet to settle your P&L. Drift Protocol

- Advanced Mode (High Leverage)

- Drift offers a High Leverage Mode (Beta) for certain markets (e.g., SOL, BTC, ETH), which allows even more aggressive leverage. Drift Protocol

- Be aware: this mode typically comes with higher fees and more risk (liquidation risk, of course). Drift Protocol

- Participation is limited; users may be removed if they drop below margin requirements. Drift Protocol